Selling a house is tough. Selling a house in foreclosure in Texas can feel impossible.

You’re facing the risk of losing your home while trying to make the best out of a hard situation.

Here’s one important fact: It’s still possible to sell your house when it’s in foreclosure in Texas.

This article will guide you through the process, from understanding the foreclosure procedure to closing a deal on your property.

[gravityform id=”1″ title=”true”]

We’ll show you that even during tough times, there are steps you can take to regain control. Keep reading for helpful insights and advice.

Ready for some good news?

Quick Summary

- You can sell your house during foreclosure in Texas through judicial or non – judicial processes.

- Act quickly to explore options like selling pre – foreclosure, which could give you more control and preserve your credit rating.

- Hiring a real estate agent experienced in foreclosures can help navigate the sale and get a good deal for your home.

- If your home is foreclosed on, you might still owe money afterward. It’s important to know about potential remaining balances or surplus funds.

- Always communicate clearly with your mortgage lender about your intentions and any steps you’re taking towards selling the house.

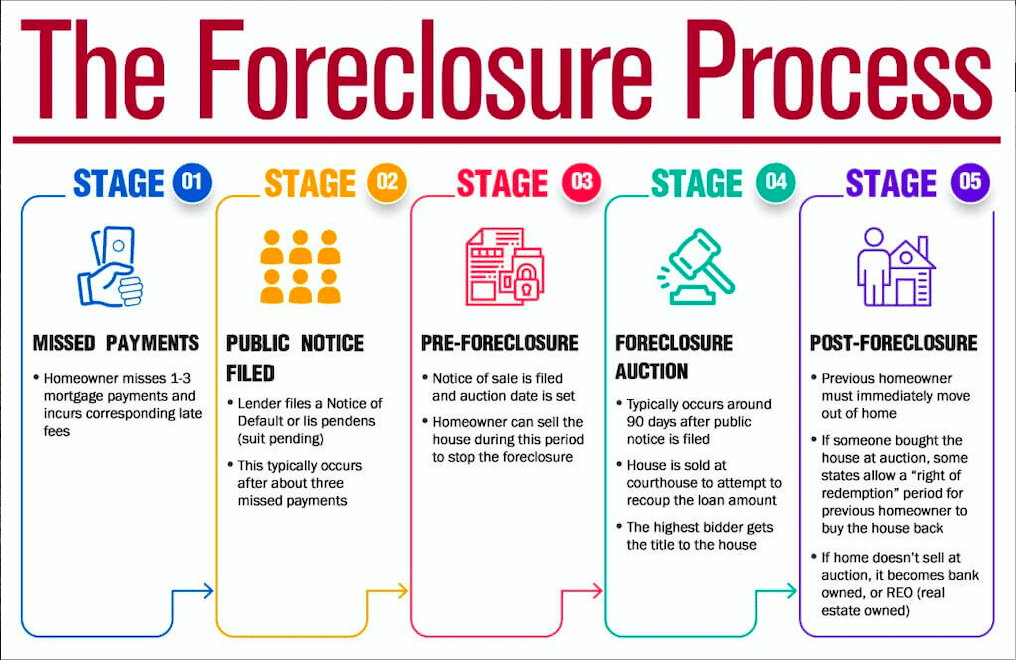

What is the Foreclosure Process in Texas?

The foreclosure process in Texas includes judicial and non-judicial procedures, with an expedited option available.

Homeowners facing foreclosure should be aware of these options to understand their situation better.

Judicial Foreclosure

Judicial foreclosure happens in Texas, but it is not as common as other types. This process starts when the lender files a lawsuit against the homeowner who has stopped making payments.

Courts get involved to oversee the entire procedure. Homeowners receive a legal notice about the lawsuit, which gives them a chance to respond.

If homeowners do not answer or lose the case, the court will order their home sold at an auction.

The auction aims to pay off the debt owed on the house. Interested buyers can bid on these properties, often leading to homes sold under market value.

Judicial foreclosures take longer than non-judicial ones because of court involvement and legal procedures that must be followed.

[gravityform id=”1″ title=”true”]

Non-Judicial Foreclosure

In a non-judicial foreclosure, the lender can sell the property without filing a lawsuit.

This process involves providing information about the debt, legal property description, and setting a three-hour sale period.

Lawsuits to challenge the foreclosure sale must be filed within two years of the sale.

Selling your home in foreclosure to a cash buyer might result in receiving a lesser cash offer compared to selling it through an agent.

However, understanding Texas foreclosure laws is crucial when considering selling your house in foreclosure.

Expedited Foreclosure

Expedited foreclosure in Texas is a streamlined process for selling a property fast.

This method typically involves providing notice to the borrower and conducting the sale within 21 days, allowing for a swift resolution.

The advantage of expedited foreclosure is its efficiency in resolving delinquent loans and reclaiming properties.

It provides an opportunity for lenders to act promptly while following Texas foreclosure laws and procedures.

Expedited foreclosures save time by bypassing lengthy court proceedings, offering a quicker path to resolving defaulted mortgages.

Can You Sell a House in Foreclosure in Texas?

Can you sell a house in foreclosure in Texas? Time is crucial, and there are advantages and challenges to consider.

Time is of the Essence

Sell your house in foreclosure quickly. Act fast to avoid further complications. Make informed decisions promptly.

The longer you wait, the fewer options you have. Take immediate action to prevent foreclosure proceedings from progressing.

Time is crucial when dealing with a house in foreclosure in Texas, so act swiftly.

Consider all viable options without delay; reinstating the loan, redeeming the property before the sale, or filing for bankruptcy can save your home from auction or sale by your lender.

Act decisively to explore these alternatives and make an informed choice at each step of the process.

Understanding Texas foreclosure laws and procedures promptly empowers you with knowledge that can help protect your rights and interests as a homeowner facing foreclosure.

[gravityform id=”1″ title=”true”]

Advantages of Selling Pre-Foreclosure

Selling before foreclosure gives you more control. Immediate negotiation for a fair price is possible. You avoid the stress of an impending auction and preserve your credit rating.

Additionally, it allows you to recover some equity from the property sale.

Furthermore, selling pre-foreclosure provides enough time to market your home effectively. This increases the chances of getting better offers and finding qualified buyers quickly.

Challenges When Selling a Home in Foreclosure

Selling a home in foreclosure poses several challenges. Time is a critical factor, as the process needs to be expedited, and finding potential buyers can be difficult due to the property’s distressed nature.

Additionally, selling a foreclosed home often means negotiating with mortgage lenders who may have specific requirements or constraints.

It is crucial for homeowners in San Antonio to navigate these complexities while striving to sell their homes swiftly and efficiently amidst financial difficulties.

The remaining amount owed after a foreclosure sale may be determined if requested by the borrower.

Lawsuits challenging the foreclosure sale must be filed within two years of the sale, adding another layer of complexity when navigating through this situation.

Options Other Than Selling

Consider reinstating the loan, redeeming the property before the sale, or filing for bankruptcy to prevent foreclosure in Texas.

It’s also possible to negotiate with your lender for a loan modification or explore government assistance programs specifically tailored towards homeowners facing financial hardship.

Remember that there are potential ways to stop a foreclosure and keep your home, providing you with options beyond selling it outright.

How to Sell a House in Foreclosure in Texas

Determine your home’s worth and notify your mortgage lender. Find a real estate agent or sell it yourself, negotiate and accept an offer, then close the property deal.

[gravityform id=”1″ title=”true”]

Determine Your Home’s Worth

To find out how much your home is worth, consider its size, location, and current condition. Look at recent sales of similar properties in your area to get an idea of the market value.

You can also hire a professional appraiser or use online tools for a more accurate estimate.

Remember that factors like upgrades and renovations can increase your home’s value.

Knowing your home’s worth is crucial when selling in foreclosure. A realistic price ensures a faster sale and sets proper expectations for potential buyers.

This enables you to make informed decisions about offers and negotiations while ensuring that you receive fair compensation for your property’s value.

Notify Your Mortgage Lender

Contact your mortgage lender as soon as possible to inform them of your intention to sell the house in foreclosure. Use clear and concise language when communicating with your lender.

Be prepared to provide details about your situation, including any potential offers on the property and how you plan to proceed with the sale.

Keep a record of all communications with your lender, noting dates, times, and the names of any representatives you speak with.

It’s crucial to stay proactive and keep open lines of communication throughout the process.

Remember that early notification can help streamline the sale process and minimize delays.

Find a Real Estate Agent or Sell it Yourself

Seek a qualified real estate agent experienced in handling foreclosure properties or opt to sell your property independently.

A seasoned agent can streamline the process, market your home effectively, and negotiate favorable terms with potential buyers.

Alternatively, selling it yourself may save on commission fees but demands meticulous attention to detail regarding legalities, pricing strategies, and marketing efforts.

Assess the benefits of both options based on your specific needs and circumstances to make an informed decision.

Remember that engaging a skilled real estate professional can help navigate the complexities of foreclosure sales more efficiently; their expertise can enhance your chances of securing a favorable outcome.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- is Selling Your House as is a Good Idea

- How To Sell My House Fast For Cash in San Antonio

- is Now a Good Time to Sell a House

- Can You Sell a House With Termite Damage

- Moving Out of State Should I Rent or Sell My House

- is FSBO a Good Idea

- Can My Husband Sell Our Home Without Me

- Can You Sell a Property With a Lis Pendens

- Why Can’t I Sell My House

- Why is a Cash Offer Better When Selling a House

- Pros and Cons of Selling a House as is

- Can I Sell My House While in Foreclosure

- What is a Subject To Mortgage in Real Estate

[gravityform id=”1″ title=”true”]

- is it Illegal to Sell a House With Termites

- If I Sell My House Will I Lose My Food Stamps

- Sell House For Cash Pros and Cons

- is Selling Your Home by Yourself a Good Idea

- is it Better To Sell Your Home For Cash

- is Selling Your Own Home Worth it

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

- Why isn’t My Home Selling Faster

- When Should You Sell Your Home as is

- How Many Missed Payments Before Foreclosure

- Is Selling Your Home and Renting a Good Idea

- is it a Good Idea to Sell My House Now

- is it Safe To Sell Your Home For Cash

- How To Sell My Mobile Home Fast For Cash

- Can You Sell a House As Is Without Inspection

- is Selling Your House a Capital Gain

Negotiate and Accept an Offer

When negotiating an offer, be clear on your home’s worth and set a realistic price. Consider offers from cash buyers and real estate agents before accepting one.

Negotiate terms that work in your favor, considering the current market conditions in San Antonio.

Keep in mind that accepting an offer can stop the foreclosure process, but you may receive a lesser amount than what is owed.

Reviewing all offers thoroughly is vital to prevent underselling as it impacts the money received after foreclosure.

Negotiating with potential buyers or investors could lead to a successful deal while navigating Texas foreclosure laws and regulations.

Close the Property Deal

To close the property deal in Texas, finalize the sale agreement with the buyer and sign all necessary paperwork.

Ensure that a title company or real estate attorney oversees the closing to ensure a smooth transaction.After signing, hand over possession of the property to complete the deal.

Once you’ve accepted an offer, negotiate terms such as closing date and seller concessions if any.

Make sure all parties are satisfied with the terms before proceeding to complete the transaction.

Then, schedule a closing meeting with all involved parties including yourself, your real estate agent, and legal representation if needed.

After finalizing everything at closing, receive your funds from the sale and transfer possession of your home to its new owner.

Remember that this action concludes your responsibilities as a seller for this particular property.

What Happens if Your Home is Foreclosed On?

Once your home is foreclosed on, you may still owe money after the foreclosure.

Finding a qualified real estate agent can help guide you through taking the next steps.

[gravityform id=”1″ title=”true”]

Owed Money After Foreclosure

After a foreclosure sale, if there’s a remaining balance on your mortgage, you may be held responsible for the difference.

This is known as a deficiency judgment. It’s important to understand that in Texas, lenders have two years to file for this judgment from the date of the foreclosure sale.

Also, if there are surplus funds after the sale of your foreclosed home, you may be entitled to claim them.

Any requests for an accounting of what was owed and what was received should be promptly addressed by the lender.

It’s crucial to familiarize yourself with these potential financial implications post-foreclosure and consult with professionals well-versed in Texas foreclosure laws and procedures.

Resources For Selling Your Home as-is:

- Need To Sell My Home Fast Pros & Cons

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

- Top Reasons To Sell Your House Fast

- The Secret To a Fast Sale of a Property

- Should I Sell My House Subject To

- Can I Sell My Deceased Parents’ House Without Probate

- How To Sell Your House Fast Without a Realtor

[gravityform id=”1″ title=”true”]

- Can You Sell a House With Unpaid Property Taxes

- Alternative Ways To Sell A House Quickly

- Can You Sell a Condemned House

- Can You Sell a House Before Probate

- After Someone Dies How Long Do You Have To Sell

- How Soon After Chapter 7 Bankruptcy Can I Sell My House

- Top 10 Ways To Sell Your Home Quickly

- Can I Sell My House If I Have a HELOC Loan

- Can You Sell Your House Without My Spouse’s Signature

- is Selling Your Home To a Real Estate Investor a Good Idea

- Is It a Good Time to Sell My House Now

- How To Sell a House That’s in Foreclosure

- I Want To Sell My Home Where Do I Start

- What is The Best Month To Sell a Home

- Who Buys Houses For Cash Near Me

- Paperwork For Selling a House Without a Realtor

- I Lost My Job Should I Sell My House

- Can I Refuse To Sell My House To an Investor

Finding a Qualified Real Estate Agent

To find a qualified real estate agent, consider their experience in selling homes in foreclosure. Look for agents familiar with Texas foreclosure laws and the local San Antonio market.

Ensure they understand the unique challenges of selling a house facing foreclosure and have a track record of successful sales in similar situations.

Additionally, seek an agent who can effectively negotiate with potential buyers to secure the best possible deal for your property.

When selecting an agent, prioritize those well-versed in distressed real estate transactions and who are skilled at marketing properties quickly.

It is essential to work with an agent who can efficiently handle the complexities of selling a home in foreclosure while ensuring compliance with all relevant regulations.

Moreover, choose an agent capable of guiding you through the process and keeping you informed about critical timelines, providing much-needed reassurance during what can be a stressful period.

Once you’ve found potential candidates, conduct thorough interviews to ascertain their understanding of your specific needs as someone looking to sell a house facing foreclosure in Texas.

Taking the Next Steps

After the foreclosure sale, homeowners should be aware of the possibility of owing additional money if the sale doesn’t cover what’s owed.

It is essential to request a detailed accounting from the lender to determine any remaining amount owed.

This information can help in planning and understanding your financial obligations following the foreclosure process.

Seeking legal advice or consulting a qualified real estate agent can provide valuable assistance and insight through this aspect.

Once a decision has been made regarding your next steps, taking action promptly is crucial.

Understanding Texas foreclosure laws and procedures are vital when considering selling a home in foreclosure.

In Summary

Selling a house in foreclosure in Texas is complex. You must act quickly and weigh your options for the best outcome.

Assessing your home’s value, notifying your lender, and enlisting help from a real estate agent are crucial steps.

Understanding the foreclosure process and seeking professional guidance can make all the difference in this challenging situation.

Remember, being well-informed and proactive is key to navigating through this process successfully.

[gravityform id=”1″ title=”true”]

FAQs

1. What does it mean to sell a house in foreclosure in Texas?

Selling a house in foreclosure means you’re trying to find a buyer for your home before the lender can sell it at a foreclosure auction due to unpaid mortgage.

2. How can I stop my house from being foreclosed and sold at an auction in Texas?

You can stop foreclosure by selling your house fast in Texas, negotiating with your lender, or considering options like a short sale where the home is sold for less than the owed amount.

3. What are the rules for a foreclosure auction in Texas?

In Texas, foreclosure auctions follow strict rules set by law, including public notices and timelines that lenders must adhere to when selling defaulted houses or bank-owned homes.

4. Can I sell my home if it’s already scheduled for an auction?

Yes, you might still have time to sell your home even if it’s scheduled for an auction through quick sales methods like finding cash buyers or exploring short sales with lender approval.

5. What should I know about the foreclosure process timeline in Texas?

The foreclosure process timeline includes several steps from default notice to auction day. Understanding this timeline helps homeowners explore all options to avoid having their home sold at auction.

Cash For Houses San Antonio?

We Pay Cash For Houses in San Antonio Regardless of Condition, Location, or Price!

Get a cash offer for your San Antonio home by filling out the short online form below.

Our team of savvy real estate problem-solvers is here to guide you through our fast home selling process and give you a fair offer on your home!

[gravityform id=”1″ title=”true”]