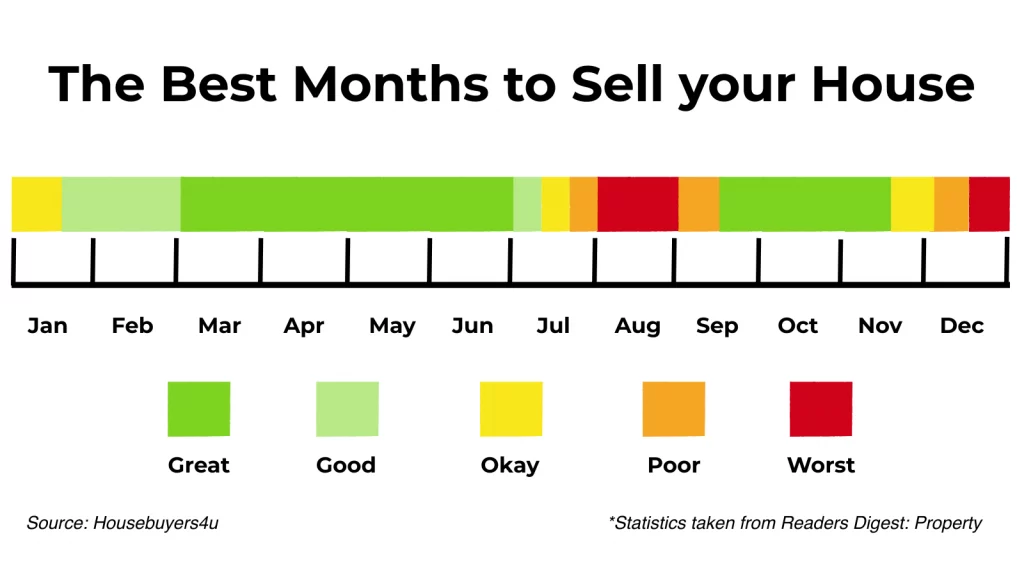

Deciding when to sell your house can feel like a big puzzle. You want the best price and a quick sale, but figuring out the perfect time isn’t easy.

Luckily, certain months might give you an edge in the housing market.

One key fact stands out: April to October are often the hottest months for selling homes, with June leading the pack for fetching top dollar.

In this article, we’ll dive into why these months shine brighter than others for sellers and how timing your sale right could mean more money in your pocket.

[gravityform id=”1″ title=”true”]

From understanding market trends to considering economic factors, we’ve got insights that could make your selling experience smoother and more profitable.

Ready to learn? Let’s get started!

Quick Summary

- June is the best month to sell your house because you can get higher prices and more homes sell above their list price.

- Selling between April and October offers benefits like quicker sales and potentially higher profits.

- Avoid selling from November to March because homes tend to stay on the market longer and sell for lower prices.

- Economic factors, such as whether it’s a buyer’s or seller’s market, affect when it’s optimal to sell your home.

Understanding the Best Time to Sell a House

Understand the best time to sell a house in San Antonio by considering seasonality, market conditions, and economic factors.

These elements play a crucial role in determining the optimal period to list a property for sale.

Seasonality

Seasonality greatly influences the real estate market, making some months better for selling houses than others. Spring emerges as the prime time for home sales, with families aiming to move during summer before a new school year starts.

This trend sees April through October as the most advantageous season to sell real estate, especially in places like San Antonio where weather can also play a significant role.

June shines as the star month within this period, boasting higher home prices and more properties selling above their listing price.

This peak time for selling a home aligns with data from ATTOM Data suggesting late spring and early summer offer the best conditions for sellers.

The ideal month to list a house becomes clear when considering these patterns alongside personal circumstances and market dynamics.

Homeowners should pay close attention to these seasonal trends while preparing to sell.

Optimal timing can significantly impact sale outcomes, highlighting June’s appeal but also underscoring the importance of local market understanding.

Sellers are encouraged to leverage these insights along with professional advice to navigate the property market effectively.

[gravityform id=”1″ title=”true”]

Peak market conditions

April to October is generally the peak time for selling houses. June, in particular, is the most popular month to list a house for sale, with high premiums and total selling prices.

Real estate research has shown that late spring and early summer are usually the best times of year to sell a home.

According to data from a real estate research firm, May is considered the best month to sell a house nationwide, with homes fetching a median sale price of $208,273.

In Florida particularly, it might be different due to hot weather and potential hurricanes; however in general optimal timing should be between April and October.

It’s advisable for homeowners in San Antonio to consider these peak market conditions when planning on putting their property up for sale.

Economic factors

Economic factors play a crucial role in determining the best time to sell your house. It’s essential to consider the current housing market and economic conditions before listing your property for sale.

According to real estate data, spring and early summer are generally ideal due to increased buyer demand and potentially higher selling prices during this period.

To ensure you make an informed decision, it may be beneficial to consult with a real estate agent or conduct thorough research based on individual circumstances.

This will help you determine the optimal time to maximize profits from selling your house and take advantage of favorable economic conditions in San Antonio’s real estate market.

Best Month to Sell a House: April to October

Sell your house between April and October for a chance to get higher home prices, more homes sold above list price, and lower median days on the market.

June is especially promising with the highest home prices, more homes sold above list price, and a shorter time on the market.

Higher home prices in June

June sees the highest home prices, with homes selling for premium amounts above the asking price.

It is one of the most profitable times to put a house on the market, making it an optimal month for selling a property.

Data shows that June tends to have the highest premiums for home sales, and May has the highest total selling prices according to real estate research firm ATTOM Data.

In addition, June typically experiences more homes being sold above list price and has lower median days on the market.

This means that houses are selling for higher than expected prices and are spending less time listed before being sold.

[gravityform id=”1″ title=”true”]

More homes sold above list price in June and July

June and July see a surge in homes selling above the asking price, bringing better returns for sellers. It’s a prime time to list your home if you aim to fetch top dollar.

In June, homes tend to command higher premiums, while May boasts the highest total selling prices.

This trend showcases the potential for profitable sales during this period in San Antonio’s real estate market.

Lower median days on market in June and July

In June and July, homes tend to sell more quickly in San Antonio. The median number of days a house is on the market during these months decreases, indicating faster sales.

This aligns with the trend across the country where late spring and early summer are prime times for selling homes due to high demand and increased buyer activity in the real estate market.

San Antonio homeowners can benefit from listing their properties in June or July as this period sees reduced time spent on the market before a sale.

Buyers are actively searching for homes during this time, making it an optimal window to attract potential buyers and expedite the selling process.

[gravityform id=”1″ title=”true”]

Worst Month to Sell a House: November to March

November to March is the least favorable period to sell a house, with lower homebuyer demand and prices.

For more insights on selling your house at the optimal time, keep reading.

Lower homebuyer demand between January and February

January and February see reduced homebuyer interest. Homes tend to stay on the market for a longer time during these months.

The median home prices also dip during this period, making it less favorable for selling a house.

These months have slower moving frequencies due to decreased buyer activity.

The winter months of January and February experience lower demand from potential homebuyers in San Antonio.

With reduced interest, homes spend more time on the market and sell for lower median prices, affecting the overall profitability of selling a property during this period.

Lower home prices in January and February

Home prices drop in January and February, making these months less favorable for selling a house. In San Antonio, the housing market sees reduced buyer demand during this time.

Median sale prices tend to decrease through these months, affecting overall profitability for homeowners looking to sell their properties.

As the winter season sets in, economic factors come into play with lower homebuyer activity decreasing demand during January and February.

Sellers may face greater challenges due to slower-moving property sales and decreased interest from potential buyers.

These conditions could impact the decision-making process for those considering listing their homes at this time of year.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- is Selling Your House as is a Good Idea

- How To Sell My House Fast For Cash in San Antonio

- is Now a Good Time to Sell a House

- Can You Sell a House With Termite Damage

- Moving Out of State Should I Rent or Sell My House

- is FSBO a Good Idea

- Can My Husband Sell Our Home Without Me

- Can You Sell a Property With a Lis Pendens

- Why Can’t I Sell My House

- Why is a Cash Offer Better When Selling a House

- Pros and Cons of Selling a House as is

- Can I Sell My House While in Foreclosure

- What is a Subject To Mortgage in Real Estate

[gravityform id=”1″ title=”true”]

- is it Illegal to Sell a House With Termites

- If I Sell My House Will I Lose My Food Stamps

- Sell House For Cash Pros and Cons

- is Selling Your Home by Yourself a Good Idea

- is it Better To Sell Your Home For Cash

- is Selling Your Own Home Worth it

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

- Why isn’t My Home Selling Faster

- When Should You Sell Your Home as is

- Is Selling Your Home and Renting a Good Idea

- is it a Good Idea to Sell My House Now

- is it Safe To Sell Your Home For Cash

- How To Sell My Mobile Home Fast For Cash

- Can You Sell a House As Is Without Inspection

- is Selling Your House a Capital Gain

Higher median days on market in February

February typically experiences a longer waiting period for selling homes, with properties staying on the market for an extended time.

Homeowners should be aware that February sees a slower turnover rate for house sales, potentially impacting the speed of a property sale in San Antonio.

It’s important to consider this factor when planning to sell a property during this month and adjust expectations accordingly.

The lengthier median days on the market during February suggest that sellers may need to strategize effectively and ensure their listing stands out to attract potential buyers in San Antonio.

Slower moving frequency from December to March

Homes tend to stay on the market for a longer time between December and March.

This is due to lower homebuyer demand during these months, resulting in reduced activity in the real estate market.

Additionally, economic factors such as holiday expenses can influence potential buyers’ willingness to make significant purchases during this period.

Choosing an optimal selling time from April through October is crucial given that June often sees the highest premiums for home sales, providing homeowners with an opportunity to maximize their profits.

[gravityform id=”1″ title=”true”]

Other Factors to Consider When Choosing the Best Time to Sell

Consider the current market conditions, such as whether it’s a buyer’s or seller’s market.

Evaluate the costs and benefits of making repairs to your home before putting it on the market.

Resources For Selling Your Home as-is:

- Need To Sell My Home Fast Pros & Cons

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

- Top Reasons To Sell Your House Fast

- The Secret To a Fast Sale of a Property

- Should I Sell My House Subject To

- Can I Sell My Deceased Parents’ House Without Probate

- How To Sell Your House Fast Without a Realtor

[gravityform id=”1″ title=”true”]

- Can You Sell a House With Unpaid Property Taxes

- Alternative Ways To Sell A House Quickly

- Can You Sell a Condemned House

- Can You Sell a House Before Probate

- How Soon After Chapter 7 Bankruptcy Can I Sell My House

- Top 10 Ways To Sell Your Home Quickly

- Can I Sell My House If I Have a HELOC Loan

- is Selling Your Home To a Real Estate Investor a Good Idea

- Is It a Good Time to Sell My House Now

- What is The Best Month To Sell a Home

- Who Buys Houses For Cash Near Me

- Paperwork For Selling a House Without a Realtor

- I Lost My Job Should I Sell My House

- Can I Refuse To Sell My House To an Investor

Selling in a buyer’s versus seller’s market

In a seller’s market, there are more potential buyers than available properties. This often leads to higher selling prices and quicker sales.

On the other hand, in a buyer’s market, there is an excess of homes for sale compared to the number of interested buyers.

In this situation, home prices may decrease due to the high competition among sellers. San Antonio homeowners should pay attention to these market conditions when deciding on the best time to sell their house.

When assessing whether it’s a buyer’s or seller’s market, keep an eye on median days on the market and how many homes are being sold above list price in your area.

Understanding these trends can help you determine if it’s advantageous or more challenging to put your property up for sale.

By staying informed about local housing supply and demand dynamics, you can strategically plan when to enter the real estate market.

Length of time living in the home

Consider the length of time you’ve lived in your home. Typically, homeowners who have lived in their homes for at least five years are eligible for tax benefits upon selling.

Longer home ownership may result in higher profits due to accrued equity and reduced capital gains taxes.

Evaluate property values over time. If the market’s appreciation rate is high, a longer period of residence often leads to substantial returns on initial investment when selling.

However, it’s essential to factor in any necessary repairs or upgrades required from prolonged occupancy to maximize potential profit when listing your house for sale.

Costs and benefits of repairs.

Repairs can increase a home’s value and appeal to potential buyers. Investing in minor repairs, such as fixing leaky faucets or repainting walls, can result in a higher sale price.

However, major renovations like kitchen remodeling may not always yield a full return on investment. Prioritize repairs that enhance the property’s overall appearance and functionality before listing your house for sale.

Consider seeking professional advice from a real estate agent when deciding which repairs will provide the most significant returns.

By addressing needed repairs before putting your home on the market, you may attract more buyers and potentially sell your house faster at a better price point.

In Summary

Sell your house from April to October for the best results. Consider June and July when home prices are higher and homes sell above list price.

Avoid selling between November and March due to lower demand and longer days on market.

Remember, engaging a real estate agent can offer valuable insights into the local market.

By understanding these trends, you’ll maximize your chances of selling at an optimal time for the best outcome.

[gravityform id=”1″ title=”true”]

FAQs about the best month of the year to sell your home

1. What is the best month to sell a house?

May is often the best month to sell a house because many buyers are looking for homes during this time, making it a prime time for selling your home.

2. Why is May considered the optimal time to sell property?

In May, the weather is nice and gardens look their best, which helps make your home more appealing. Also, families want to move during summer break, making it an ideal time.

3. Is there a worst time to list my house for sale?

Yes, winter months like December can be challenging due to cold weather and holiday distractions, making it less favorable for selling real estate.

4. Can the best month change based on where I live?

Absolutely! The best timing for selling a house can vary in specific regions due to different climates and market trends.

5. Are there any tips for selling my home outside of the optimal season?

Yes! Improving your home’s appeal with good lighting and staging can help attract buyers even during less advantageous times like late fall or early winter.

Cash For Houses San Antonio?

We Pay Cash For Houses in San Antonio Regardless of Condition, Location, or Price!

Get a cash offer for your San Antonio home by filling out the short online form below.

Our team of savvy real estate problem-solvers is here to guide you through our fast home selling process and give you a fair offer on your home!

[gravityform id=”1″ title=”true”]