Are you thinking about selling your home in San Antonio, Texas, but feeling overwhelmed by how long it might take? You’re not alone. Many homeowners want a quick and stress-free sale, especially when life throws curveballs like financial hardship or sudden relocations.

Selling fast can offer relief and simplicity during these times.

One amazing fact to consider: homes in San Antonio are selling quickly due to strong demand from buyers! This means that you could potentially sell your house faster than you think. Our blog is packed with insights on why a speedy sale could be beneficial for you and the top ways to achieve it without any hassle.

Get ready for valuable tips that will help guide your swift home-selling journey in San Antonio.

Keep reading for advice tailored just for San Antonio homeowners like you!

Quick Summary

- Homes in San Antonio are selling quickly because there is a lot of demand from buyers.

- Selling your house for cash means you don’t have to fix it up first, and it can happen fast.

- If you need to move or are having money troubles, selling your house quickly in San Antonio can help you sort things out faster.

- Working with a good agent can help sell your house faster because they know the market well and have lots of buyers they can talk to.

- The best time to sell a house in San Antonio is late spring through July when homes tend to sell quicker and for more money.

Why Sell Your House Fast in San Antonio, Texas?

If you’re facing financial struggles, need to make major repairs, or are relocating for work or personal reasons, selling your house quickly in San Antonio can alleviate stress and provide a quick solution.

There are many reasons why homeowners may need to sell their houses fast.

Financial Struggles

Money problems can push you to sell your house fast in San Antonio. Maybe you lost your job or have big bills that you can’t pay. When cash gets tight, waiting a long time for a sale isn’t an option.

Selling your home quickly means you get money sooner to help with these struggles.

Some people choose a quick house sale in San Antonio to stop worrying about money issues. You might do this too if it feels like the right step for you. Getting cash for your house could give you peace of mind and let you move on from financial stress fast.

Need for Repairs

If you’re facing the need for repairs, selling your house fast in San Antonio, Texas can save you from the hassle. Getting a cash offer for your home means you won’t have to worry about fixing any issues before the sale.

This quick property transaction option allows you to bypass the time and expense of making repairs, providing a swift home buyout without the stress of renovation costs or delays.

Relocation

If you’re considering relocating due to a job change, family reasons, or other circumstances, selling your house quickly in San Antonio can provide the flexibility and financial means for a smooth transition.

With the current demand in the San Antonio real estate market, selling your home swiftly can help free up capital for your relocation expenses and ease any financial burdens associated with moving.

This is especially beneficial during times of shifting market conditions when swift property transactions are advantageous.

Considering the strong demand for property in San Antonio and the potential for higher sale proceeds in today’s market, selling your house fast can offer you the opportunity to efficiently transition to your new location without undue stress.

Other Reasons for Needing a Fast Sale

If you’re considering a fast sale, there are various reasons to do so.

Here are some other crucial reasons for needing a quick house sale in San Antonio, Texas:

- Financial Struggles: If you’re facing financial hardship and need immediate funds to alleviate the situation, selling your house quickly for cash can provide the necessary relief.

- Divorce or Separation: In cases of divorce or separation, a rapid property transaction can help in swiftly dividing assets and moving on with life.

- Inherited Property: Managing an inherited property can be overwhelming, and opting for a fast sale can ease the burden and provide liquidity.

- Avoiding Foreclosure: Selling your house fast can prevent foreclosure and its damaging effects on your credit score and financial well-being.

- Health Issues: When dealing with health concerns, selling the house quickly can provide vital resources for medical expenses or lifestyle adjustments.

- Downsizing: If you’re looking to downsize your living space or simplify your life, a rapid property sale can facilitate this transition efficiently.

Top Options for Selling Your House Fast in San Antonio

Consider a cash sale or working with a top agent to expedite the selling process. To explore the best options for your fast home sale, keep reading!

Cash Sale

Selling your house for cash in San Antonio offers a quick and efficient way to offload your property without the hassle of repairs or renovations. This method is particularly beneficial in the current market conditions, where demand from buyers is high, and there’s an opportunity to earn higher sale proceeds.

With increasing home prices and pent-up demand from purchasers, opting for a cash sale can expedite the selling process and provide you with immediate funds, especially as late spring through July are considered optimal months for selling a house in San Antonio.

Now let’s explore another effective option for selling your house fast – working with a top agent.

Working with a Top Agent

When considering the option of working with a top agent to sell your house fast in San Antonio, Texas, it’s essential to understand the benefits. A reputable agent can offer valuable insights into current market conditions and trends, helping you navigate the selling process more effectively.

They have access to extensive networks and potential buyers, enhancing your chances of a swift property sale. With their expertise, they can also assist in strategizing for a fast sale and determining the best time to sell in San Antonio, TX based on demand and optimal selling months.

It’s important to note that an experienced agent can help capitalize on the strong demand in San Antonio’s real estate market due to factors such as pent-up buyer demand post-COVID and favorable seasonal selling windows.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- How To Sell My House Fast For Cash in San Antonio

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

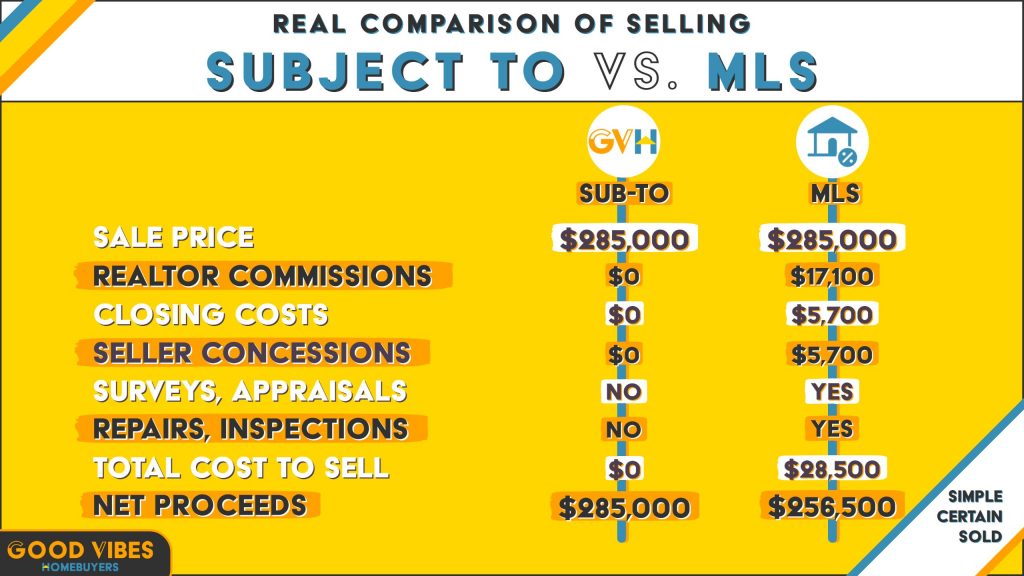

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

- Top Reasons To Sell Your House Fast

- Should I Sell My House Subject To

Factors to Consider Before Selling

Before selling your house fast in San Antonio, it’s crucial to consider the current market conditions and trends, as well as strategies for a fast sale and the best time to sell in San Antonio, TX.

Read on to learn more about these important factors!

Current Market Conditions and Trends

The real estate market in San Antonio, Texas is showing strength, with rising home prices and quick property sales. Demand for houses is high, driven partly by delayed home searches during the winter due to Covid.

This pent-up demand from buyers creates a favorable environment for selling a house quickly in San Antonio. The current market trends indicate that now might be an advantageous time to consider selling your house in San Antonio, given the strong demand and potential for higher sale proceeds.

Factors such as the time of year can affect the speed of selling a house in San Antonio, making late spring through July the best months for selling a house. It’s important to note that average timeframes for selling vary by zip code within San Antonio, emphasizing how crucial it is to be aware of local market conditions when considering putting your house on the market.

Strategies for a Fast Sale

In light of the current market conditions and trends, here are some strategies for a fast sale:

- Consider making minor upgrades to enhance curb appeal and attract more buyers. Simple improvements like fresh paint or landscaping can make a big difference.

- Set the right price from the start. Research local market trends and recent sales to determine a competitive listing price that will generate interest.

- Utilize professional photography and staging to showcase your property in its best light. High-quality visuals can significantly impact buyer perception.

- Host open houses during peak selling seasons, such as late spring and early summer, to maximize exposure and attract motivated buyers.

- Collaborate with a reputable real estate agent who has a strong track record of successful sales in your area. An experienced agent can provide valuable insights and guidance throughout the selling process.

- Highlight the unique features and benefits of your property to stand out in a competitive market. Emphasizing what makes your home special can capture buyer attention.

- Leverage digital marketing platforms and social media to reach a broader audience of potential buyers. Online visibility is crucial in today’s real estate landscape.

- Be flexible with showings and accommodating potential buyer schedules. Making your home readily accessible can lead to quicker offers and a faster sale.

Best Time to Sell in San Antonio, TX

Late spring through July is the best time to sell a house in San Antonio, Texas. This period often results in faster sales and higher proceeds. May and June specifically show increased speed of selling homes due to favorable market conditions and rising demand from buyers.

The real estate market in San Antonio is currently shifting towards favoring buyers, making it a good opportunity for homeowners to consider selling.

Considering the current market conditions and strong demand, now may be an advantageous time to sell your house in San Antonio, Texas. These factors have led to pent-up demand among purchasers since the start of Covid, presenting an excellent opportunity for homeowners looking for a fast sale.

In Conclusion

Deciding to sell your home fast in San Antonio, Texas offers numerous benefits. By capitalizing on the strong real estate market and increasing home prices, you can swiftly overcome financial struggles or the need for repairs.

Options like cash sales and working with top agents provide efficient ways to sell your house quickly. The current buyer-friendly market makes it an opportune time to act. What practical steps will you take to reap these benefits? Consider exploring further resources or seeking professional guidance as you embark on this rewarding journey toward a swift property sale.

Top Reasons To Sell Your Home Fast in San Antonio FAQs

1. Why should I sell my house fast in San Antonio, Texas?

Selling your house fast in San Antonio gets you a quick cash offer, allowing for a speedy property sale without the need for repairs or an agent.

2. What are the benefits of selling my home quickly in San Antonio?

When you sell your home quickly in San Antonio, you get fast cash offers and can avoid long waiting times and the hassle of dealing with lots of paperwork.

3. Can I sell my house for cash in San Antonio?

Yes! In San Antonio, Texas, you can get immediate house purchase offers where companies give you cash for your house swiftly.

4. Is it possible to sell my house without making repairs in San Antonio?

Absolutely! Selling your house for cash means you can skip repairs and sell it as-is, which makes your home sale process much faster.

5. How does a speedy home buyout work in San Antonio?

A quick home sale company will give you an offer right away so that you can have a rapid property sale without usual selling steps like showcasing your home or hiring an agent.

Do you need to sell your San Antonio home quickly, give us call at (210) 570-4984 or fill out the short online form.

Our team of savvy real estate problem-solvers is here to guide you through our fast home buying process and give you a fair offer on your home!