Yes, you can sell your house if it’s in foreclosure in Texas. This is a vital option for homeowners looking to avoid the full hit of foreclosure on their credit report and financial stability.

Acting swiftly is crucial as this allows more room to negotiate with buyers and settle any debts with the bank.

It’s also key to keep open lines of communication with your lender; they might offer solutions or alternatives that could assist in selling your home faster.

If you manage to sell the house for more than what you owe, the extra money goes towards paying off any other debts tied to the property.

Selling a house while in foreclosure often leads homeowners to consider underselling just to quickly move on.

[gravityform id=”1″ title=”true”]

Yet, exploring all avenues thoroughly before making such decisions can prevent unnecessary losses.

Engaging with legal advice early in the process helps understand rights and options, potentially leading to outcomes more favorable than initially expected.

Understanding the Foreclosure Process in Texas

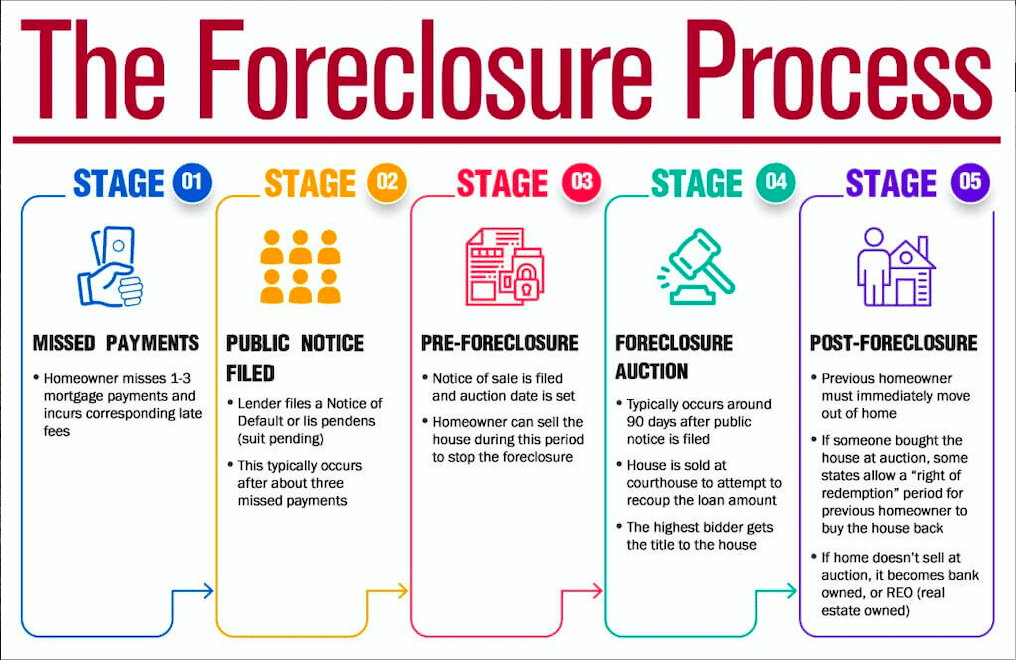

The foreclosure process in Texas has a specific timeline and carries serious consequences. It involves an auction date and potential eviction, so it’s crucial to be aware of the complexities involved.

Timeline of the process

Selling a house in foreclosure in Texas requires understanding the timeline of the foreclosure process. Homeowners in San Antonio should act quickly to stop foreclosure and explore their options.

- Missed Payments: After missing payments for 3-6 months, lenders typically issue a notice of default.

- Notice of Default: This legal notice signals the start of the formal foreclosure process.

- Pre-foreclosure Period: Homeowners have approximately 20 days after receiving the notice to resolve the debt or sell the home.

- Notice of Sale: If the debt remains unpaid, lenders will then provide at least 21 days’ notice before selling the property at auction.

- Auction Date: The house is sold to the highest bidder at a public auction set by the county in which the property is located.

- Eviction Case: Following auction, new owners may initiate an eviction case if necessary, giving former homeowners a short timeframe to vacate.

Homeowners should communicate with their lender and seek advice on Texas foreclosure prevention options early in this process. Selling a home prior to auction could avoid bank ownership and might allow homeowners to claim surplus funds from foreclosure, depending on how much more than mortgage amount it sells for.

Consequences of foreclosure

Foreclosure leads to losing your home and damaging your credit score. It can also result in deficiency, where you owe the remaining balance even after the house is sold.

This may lead to financial struggles and difficulty obtaining future loans.

The impact of foreclosure goes beyond losing your home; it affects your financial stability and could hinder future housing options.

Additionally, it tarnishes your credit history, making it challenging to secure new lines of credit or loans in the future.

Exploring Options for Selling a Home in Foreclosure

Explore options such as forbearance agreements and loan modifications for selling a home in foreclosure.

Consider refinancing, deed in lieu of foreclosure, or opting for a short sale when facing this situation.

[gravityform id=”1″ title=”true”]

Forbearance agreement

A forbearance agreement is an arrangement with your lender to temporarily suspend or reduce mortgage payments.

This can provide short-term relief if you’re facing financial hardship, giving you time to get back on track.

It’s crucial to understand the terms and conditions of the forbearance agreement before taking this step, as it may impact your credit and future loan repayment.

The goal is to prevent foreclosure while working out a plan for resuming regular payments once your financial situation improves.

It’s essential to communicate openly with your lender and explore all available options when considering a forbearance agreement.

Loan modification

Loan modification adjusts the terms of your existing mortgage, offering a potential solution to foreclosure.

By working with your lender, you may be able to negotiate a lower interest rate, extended loan term, or even a reduction in the principal balance.

This can make your monthly payments more manageable and help you avoid losing your home.

It’s essential to act promptly and openly communicate with your lender about this option as part of preventing foreclosure.

By considering loan modification for selling a house in foreclosure in Texas, homeowners may find an alternative that allows them to keep their homes or achieve a favorable outcome when selling.

Refinancing

Yes, refinancing your home could help you when faced with foreclosure in Texas.

By renegotiating the terms of your mortgage, you may secure a lower interest rate or extend the repayment period, reducing your monthly payments and helping you avoid foreclosure.

It’s important to act quickly as timing is crucial when considering this option. If done right, it can provide relief by making your mortgage payments more manageable and preventing the loss of your home.

Another potential advantage is that refinancing might allow you to access equity in your home, enabling you to pay off debts or cover any remaining mortgage balance.

Partnering with a lender who understands the nuances of foreclosure situations can provide invaluable guidance during this process.

[gravityform id=”1″ title=”true”]

Deed in lieu of foreclosure

When facing foreclosure, homeowners in Texas can consider a deed in lieu of foreclosure.

This option involves transferring ownership of the property to the lender instead of going through the foreclosure process.

It allows homeowners to avoid the negative impact of a full foreclosure on their credit history.

However, it is important to understand that this may not fully absolve all debts related to the mortgage and could still have an impact on your future ability to secure loans or mortgages.

The deed in lieu of foreclosure provides an alternative for homeowners who are unable to keep up with mortgage payments and want to release themselves from ownership responsibilities without going through a full foreclosure process.

Short sale

Yes, you can consider a short sale to avoid foreclosure in Texas. This option involves selling your home for less than what is owed on the mortgage.

The lender may agree to forgive the remaining balance, but it’s important to understand that this forgiven amount could be considered taxable income.

A short sale can help prevent foreclosure and minimize the impact on your credit score, providing an alternative to consider when facing financial difficulties and potential foreclosure proceedings in Texas.

Selling a house through a short sale requires negotiation with the lender and careful consideration of potential tax implications.

It’s crucial to act promptly and engage with professional advice as you navigate this option amidst pending foreclosure.

Overcoming Obstacles When Selling a Home in Foreclosure

When selling a home in foreclosure, overcoming obstacles such as no longer living in the property, being tied to litigation, or navigating the process alone can be challenging.

It’s important to seek guidance and support to successfully navigate through these complexities.

Owner no longer living

If the owner is no longer living, legal issues and complexities may arise in selling the house.

It’s essential to seek guidance from a trusted legal professional to navigate this situation thoughtfully.

Moreover, it’s crucial to communicate with the lender and understand the implications of selling a home in foreclosure when the owner is deceased or no longer residing in the property, including any remaining debts or potential surplus funds.

In such situations, understanding Texas foreclosure laws becomes pivotal as they underpin the process of selling a house when the owner is no longer living.

Seeking legal advice can help homeowners comprehend their rights and obligations meticulously.

Additionally, exploring options for probate or estate sale could be beneficial while navigating these circumstances.

[gravityform id=”1″ title=”true”]

Home tied to litigation

Selling a home caught up in legal disputes can be challenging, especially when trying to prevent foreclosure.

Legal issues may complicate the sale process and impact the timeframe and potential buyers’ interest.

When a home is tied to litigation, it’s crucial to seek legal advice to navigate the complexities of selling amidst ongoing legal proceedings, protecting your interests and ensuring a smooth transaction.

Understanding how litigation affects the sale can help homeowners make informed decisions about their options for resolving the situation.

Additional Real Estate Advice:

- Working With A Realtor To Sell Your House in San Antonio

- Tips For Selling Your House For Cash Quickly

- is Selling Your House as is a Good Idea

- How To Sell My House Fast For Cash in San Antonio

- is Now a Good Time to Sell a House

- Can You Sell a House With Termite Damage

- Moving Out of State Should I Rent or Sell My House

- is FSBO a Good Idea

- Can My Husband Sell Our Home Without Me

- Can You Sell a Property With a Lis Pendens

- Why Can’t I Sell My House

- Why is a Cash Offer Better When Selling a House

- Pros and Cons of Selling a House as is

- Can I Sell My House While in Foreclosure

- What is a Subject To Mortgage in Real Estate

[gravityform id=”1″ title=”true”]

- is it Illegal to Sell a House With Termites

- If I Sell My House Will I Lose My Food Stamps

- Sell House For Cash Pros and Cons

- is Selling Your Home by Yourself a Good Idea

- is it Better To Sell Your Home For Cash

- is Selling Your Own Home Worth it

- The Benefits of Selling a House Fast For Cash in San Antonio

- Can I Sell My House To My Friend Without a Realtor

- Why isn’t My Home Selling Faster

- When Should You Sell Your Home as is

- How Many Missed Payments Before Foreclosure

- Is Selling Your Home and Renting a Good Idea

- is it a Good Idea to Sell My House Now

- is it Safe To Sell Your Home For Cash

- How To Sell My Mobile Home Fast For Cash

- Can You Sell a House As Is Without Inspection

- is Selling Your House a Capital Gain

Selling alone

When selling your house in foreclosure on your own, act quickly and communicate with your lender about potential solutions. Seek legal advice to navigate the process and understand any financial implications.

Remember that even if the house has equity, the bank incurs expenses with foreclosure.

It’s crucial to consider all options before making a decision, as surplus funds from the sale could be claimed, but it’s important to be aware of the process and requirements.

Lastly, if your house is sold at auction, there may be a timeline for you to move out.

Resources and Support for Selling a Home in Foreclosure

Explore the Texas State Law Library and federal laws regarding selling a home in foreclosure.

Discover the potential legal consequences, including impacts on credit score and options for selling to a cash home buyer.

Texas State Law Library

The Texas State Law Library provides resources and support for homeowners dealing with foreclosure.

Whether you need information on foreclosure laws in Texas or federal laws, the library is a valuable source of knowledge.

You can also find details about possible legal consequences and how selling to a cash home buyer may impact your credit score.

If you’re looking for advice tailored to the complexities of Texas foreclosure laws, this resource is designed to enhance your understanding.

With the everchanging world of foreclosure, seeking more than just legal documentation is advisable.

The Texas State Law Library offers a suite of resources that dives into the heart of foreclosure matters, providing robust insights into possible options and outcomes specific to Texas homeowners.

[gravityform id=”1″ title=”true”]

Federal laws

Federal laws play a crucial role in governing the foreclosure process. These laws provide important protections for homeowners facing foreclosure in Texas and outline specific procedures that lenders must follow.

When navigating through the complexities of selling a house in foreclosure, it’s essential to understand how federal laws can impact the process.

Not only do these laws underpin the rights of homeowners, but they also offer avenues for seeking additional support and protection throughout this challenging time.

Understanding federal laws related to foreclosure can help homeowners make informed decisions and ensure their rights are upheld as they explore options for selling their home.

When a homeowner is dealing with a potential foreclosure scenario, being well-informed about federal laws is crucial as these regulations directly impact their options and rights throughout the process.

Resources For Selling Your Home as-is:

- Need To Sell My Home Fast Pros & Cons

- How Much Does it Cost To Sell a House in Texas

- Can I Sell My Parents Home With a Power of Attorney

- Can You Sell a House With Mold in Texas

- Can I Sell My Home If I’m in Foreclosure

- Can You Sell Your Home With Code Violations in Texas

- Can I Sell My Home and Still Live it Rent-Free

- Can You Sell a House With a Mortgage

- Top Reasons To Sell Your House Fast

- The Secret To a Fast Sale of a Property

- Should I Sell My House Subject To

- Can I Sell My Deceased Parents’ House Without Probate

- How To Sell Your House Fast Without a Realtor

[gravityform id=”1″ title=”true”]

- Can You Sell a House With Unpaid Property Taxes

- Alternative Ways To Sell A House Quickly

- Can You Sell a Condemned House

- Can You Sell a House Before Probate

- After Someone Dies How Long Do You Have To Sell

- How Soon After Chapter 7 Bankruptcy Can I Sell My House

- Top 10 Ways To Sell Your Home Quickly

- Can I Sell My House If I Have a HELOC Loan

- Can You Sell Your House Without My Spouse’s Signature

- is Selling Your Home To a Real Estate Investor a Good Idea

- Is It a Good Time to Sell My House Now

- How To Sell a House That’s in Foreclosure

- I Want To Sell My Home Where Do I Start

- What is The Best Month To Sell a Home

- Who Buys Houses For Cash Near Me

- Paperwork For Selling a House Without a Realtor

- I Lost My Job Should I Sell My House

- Can I Refuse To Sell My House To an Investor

Possible legal consequences

Selling a house in foreclosure may result in legal implications, and it’s essential to be aware of these.

Possible legal consequences include the lender pursuing a deficiency judgment for any remaining debt after the sale, as well as potential claims from junior lienholders.

Additionally, failing to comply with specific legal requirements during the sales process could lead to complications, making it crucial to seek professional advice and thoroughly understand your rights and obligations.

It’s important to note that selling a house in foreclosure involves complex legal considerations.

Actively engaging with legal counsel can provide insight into navigating potential ramifications effectively.

Selling to a cash home buyer

Selling to a cash home buyer can be a swift solution if you’re facing foreclosure in Texas. These buyers purchase houses directly, often without the need for repairs or real estate agents.

The process tends to be faster than traditional sales, allowing homeowners to swiftly address their impending foreclosure situation and avoid auction scenarios.

Moreover, selling to cash home buyers could provide an option for those needing quick resolution as these transactions usually close within days rather than weeks.

If your house is sold at auction due to foreclosure in Texas, there may be a limited timeframe for you to vacate the property.

Selling to a cash home buyer might offer more control over the moving timeline compared to auctions, offering homeowners greater flexibility during this challenging time.

Possible impact on credit score

Selling your house in foreclosure in Texas can impact your credit score. The foreclosure itself already has a negative effect, but selling the property before that happens may cause less damage to your credit.

However, if you’re able to sell for more than what’s owed on the mortgage, it could help mitigate some of the impact on your credit score.

It’s crucial to be aware that any late payments or missed mortgage payments leading up to the foreclosure process will have an adverse effect on your credit score as well.

Therefore, understanding how selling a house in foreclosure affects your credit and seeking guidance from financial advisors and credit counselors can be essential in managing this aspect of the situation.

In Summary

You’re able to sell your house during a foreclosure in Texas.

Act quickly and consult with your lender for potential solutions. It’s important to consider all options before selling.

Communicate with your lender and seek legal advice too.

Stress the importance of understanding the process and seeking professional help for successful navigation.

[gravityform id=”1″ title=”true”]

FAQs

1. Can I sell my house if it’s in foreclosure in Texas?

Yes, you can sell your house even if you are behind on payments or in foreclosure in Texas. This action might help you avoid the foreclosure process.

2. What should I do to sell my house before it goes to auction in Texas?

To sell your house before it is sold at auction, act quickly to list the property and find a buyer. You might also explore Texas foreclosure help programs for assistance.

3. How does selling a house work if the bank owns it due to foreclosure?

If the bank has taken ownership of your property through foreclosure, you cannot sell the home without negotiating with the bank first.

4. Are there programs in Texas that can help me avoid foreclosure by selling my home?

Yes, there are mediation and assistance programs available in Texas designed to help homeowners explore options like selling their homes before reaching full foreclosure.

Cash For Houses San Antonio?

We Pay Cash For Houses in San Antonio Regardless of Condition, Location, or Price!

Get a cash offer for your San Antonio home by filling out the short online form below.

Our team of savvy real estate problem-solvers is here to guide you through our fast home selling process and give you a fair offer on your home!

[gravityform id=”1″ title=”true”]